Environmental, Social, and Governance (ESG) concerns are no longer part of optional discussions. They influence how investors rate companies, how customers rate buying decisions, and the enforcement of compliance by the regulators. ESG risks have become equally prominent with operational and financial risks within the board of many organisations.

With increasing ESG demands, your insurance strategy needs to be reviewed. Firms that do not match their coverage with the ESG exposure can experience significant gaps. This is where it becomes necessary to work hand in hand with a professional insurance advisor.

We discuss some of the most important ESG risks and business insurance implications that accompany them below.

Understanding ESG Risks

The risks associated with ESG can be broadly divided into three groups:

-

Climate change, pollution, carbon emissions, resource scarcity, and environmental liability are environmental risks.

-

Social risks are associated with labour practices, workplace safety, diversity and inclusion, supply chain standards, and community impact.

-

Governance risks include corporate leadership, executive compensation, compliance failures, data privacy, and transparency.

All of these places can initiate suits, regulatory penalties, tarnished reputations, and shareholder litigation. A well-informed insurance advisor will assist companies in determining how these risks translate into actual insurance exposures.

Environmental Risks and Insurance Implications

The risk environment is transforming due to climate change. Flooding, wildfires, storms and extreme weather events are increasingly common and severe. Companies in risky areas can also experience increased property insurance premiums or underwriting conditions.

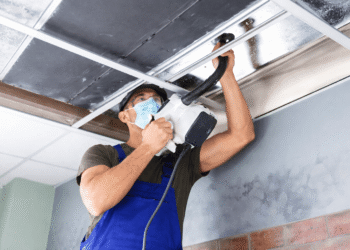

Another significant issue is environmental liability. When dealing with hazardous substances or industrial plants, companies are exposed to possible pollution claims. Pollution-related incidents are usually not covered by the standard general liability policies; specialised environmental insurance might be required.

A qualified insurance consultant will be able to analyse the relevance of your existing property, liability, and environmental insurance policies to risks associated with climate change. They may also assist in determining the extra coverage required to cover regulatory action or remediation expenses.

Social Risks and Workforce Liability

Financial performance is becoming more closely related to social issues. Unsafe labour conditions, discrimination lawsuits, and harassment claims in the workplace are all likely to cause expensive legal battles and negative publicity.

Employment Practices Liability Insurance (EPLI) is essential in dealing with such risks. EPLI includes claims of wrongful termination, harassment, and discrimination. Global supply chain companies can also be subject to scrutiny on labour practices in foreign countries, which can cause reputational and legal liability.

An active insurance advisor will examine internal policies, HR practices and history of claims to advise on suitable liability limits. They may also propose improvements in risk management, which will minimise exposure to risk before a claim can occur.

The other umbrella of social and governance is cybersecurity. Hack attacks impact customers, employees, and business partners. Insurance of cyber liability has become a fundamental element of risk management under the ESG. Data breach, ransomware, and regulatory fines can be insured by an insurance advisor.

Directors & Officers Coverage and Governance Risks

Good corporate governance is one of the pillars of ESG performance. Lack of proper supervision, ineffective disclosure, or lack of compliance regulations may result in shareholder litigation and regulatory inquiries.

Of particular importance to this case is Directors and Officers (D&O) insurance. D&O covers assist executives and board members if they are personally liable due to the actions taken during their leadership capacity.

With increased adoption of ESG disclosures, companies are likely to encounter lawsuits regarding perceived misunderstandings of sustainability-related objectives or climate promises. In case the stakeholders feel that a firm has exaggerated its ESG performance, it may end up being sued.

An experienced insurance consultant will evaluate whether D&O coverage limits are adequate due to increased ESG scrutiny. It is also possible to review policy wording to make sure that emerging ESG-related claims are not implicitly disallowed.

ESG Reporting and Disclosure Risk

A large number of businesses today release sustainability reports or set carbon targets. Transparency breeds trust, but it breeds risk as well. False or misstated ESG reports may lead to regulatory enforcement or shareholder lawsuits.

These claims may be covered by Errors and Omissions (E&O) insurance and D&O insurance, though the details of coverage are important. A knowledgeable insurance consultant will discuss the coverage of ESG-related disclosures on the current policies and suggest changes where needed.

International businesses also need to take into consideration different regulatory requirements in different jurisdictions. The compliance requirements of ESG vary significantly, and insurance coverage should express the disparities.

Crisis Management and Reputational Risk

Reputation can be a key asset of a company. The failures of ESG can rapidly turn into crises. Media attention and customer response can be provoked by environmental spills, labour problems, or governance scandals.

Crisis management or coverage of PR expenses is provided in some insurance policies. Such provisions are capable of regulating communication efforts and reducing long-term harm.

An informed insurance agent can tell you whether your policies cover crisis response and whether those amounts are sufficient for the industry and size that you run.

The Act of an Insurance Advisor in ESG Strategy

There is more to ESG risk management than acquiring additional insurance. It is concerned with matching coverage to changing exposures. A good insurance consultant does not just write policies. They study your activity, find weaknesses, and liaise with legal and compliance units.

The insurance advisor can add value in the following way:

-

Systematically performs risk evaluation in relation to ESG exposures.

-

Assess current policies on exclusions and gaps in coverage.

-

Proposes reasonable limits according to industry trends.

-

Recommends on upcoming risks like climate disclosure liability.

-

Promotes the continuous reduction of risks.

Clearly, the need to adapt to new ESG regulations and stakeholder demands has pushed companies to view their insurance advisor as more of a strategic partner than a transactional vendor.

The Future of ESG Risk: Preparation

The ESG environment will become even more complicated. Investors are seeking transparency. Enforcement is being enhanced by regulators. Customers demand responsibility.

Companies that actively analyse their insurance policies are in a better place to manage ESG claims. Having a reliable insurance advisor is a way of guaranteeing that coverage remains abreast with regulatory reforms and new threats.

Thoughtful insurance planning is essential in a world where environmental events, social issues and failures in governance can easily transform into legal and financial crises. Given the proper guidance through a seasoned insurance counsel, companies are able to safeguard their management, reputation and their own success over time.